Leave a Comment

Posted on December 2, 2021

Raising the National Debt ceiling may seem routine, however, increasing political bias in both parties has made the process anything but simple. Arguments over which party has contributed more to the deficit, through tax cuts or entitlement packages, are passionately articulated, while anxiety grows around the world.

But does raising the debt ceiling really matter? In a word, “yes”. Default would be unthinkable and for that reason history has shown that legislators on both sides of the aisle eventually come together, but not without a fight that can and often does disrupt financial markets. So, should we be concerned? Perhaps, but the question is to what degree. Continue reading for a thoughtful analysis of the impact and implications.

Uncertainty may disrupt financial markets as Congress works toward a deal.

Key takeaways

- The statutory debt limit, the country’s borrowing limit, was suspended in 2019 and the suspension ended on July 31, 2021.

- Democrats and Republicans in Congress avoided a default in October by agreeing to extend the debt limit through early December.

- History suggests that the issue will likely be resolved—after some tense political negotiations.

The suspension of the debt ceiling ended July 31 and Congress has extended the deadline to raise it to December 3, 2021. If the debt ceiling is not raised or suspended again before that time, the Treasury would be unable to issue more Treasury securities and the nation could default on its debt.

History suggests that is unlikely. Congress has always acted to forestall default, though often at the last minute after considerable high-stakes wrangling. That can cause some short-term market volatility.

While that can be upsetting, there are a few things investors can take comfort in:

- The stock market remains in a long-running bull market, which means the long-term trend may be up.

- Corporate earnings have been strong this year. As of the first week in November, 447 companies in the S&P 500 Index had reported earnings, with 81% beating estimates by an average of 9.5%.

- The economy is doing well—the US is still in a mid-cycle expansion as are many major economies including Europe. US consumers are generally doing well too, with savings levels up and debt levels down.

- Despite the Federal Reserve starting to taper asset purchases in November, monetary policy is still very accommodative as interest rates remain very low which is supportive of asset prices.

Says Lars Schuster, institutional portfolio manager in Fidelity’s Strategic Advisers group: “It’s unnerving for investors to see these continual headlines. However, any potential short-term volatility in the markets could be a good buying opportunity.”

Default is unthinkable—so many experts aren’t that worried

The debt ceiling has, in the past, spurred contentious and prolonged debate about fiscal responsibility and the growing national debt.

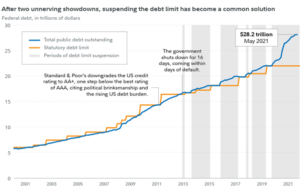

In 2011, the disagreements went so far that the credit rating agency Standard & Poor’s downgraded the US credit rating to AA+, one step below the best rating of AAA, where it remains today. Standard & Poor’s cited the growing deficit and the prolonged debate as reasons for the downgrade.

This year, as the final deadline looms, the debt-ceiling debate could be a contentious one again. In October, Mitch McConnell, Senate Minority Leader, came under fire from his own party after offering the short-term suspension of the debt ceiling which moved the deadline from October to early December. Without Republican assistance to raise the debt limit or suspend it, Democrats can only use reconciliation to raise the spending limit. That process requires putting a number on the spending limit, making it a politically risky move for Democrats wary of being cast as spendthrifts in upcoming Congressional races.

“It could get really ugly before it gets resolved,” says Andy Vermilye, vice president of government relations at Fidelity.

Historically, raising the debt ceiling has not been a battle legislators want to fight. Administration officials usually work behind the scenes to convince legislators of the importance of raising the limit relatively quickly and without fanfare. This approach helps limit financial market uncertainty, minimizing the potential for government borrowing costs to increase amid a debt-ceiling debate, while reducing investor concerns.

What’s more, many of the same policymakers who negotiated the 2011 debt-ceiling raise will be at the table 10 years later, such as President Biden, Senate Minority Leader McConnell, House Speaker Pelosi, and House Majority Leader Hoyer.

Source: Congressional Research Service, Congressional Budget Office, and the Treasury Department. Data as of 05/01/2021.

Today’s debt

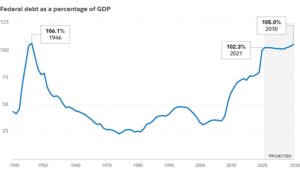

One thing separating today’s debt debate from those of the past is the larger-than-ever national debt. Publicly held US debt topped 100% of GDP in 2020 and is expected to reach 102% by the end of 2021.

And the debt is projected to increase significantly in the future. The Congressional Budget Office (CBO) projects a federal budget deficit of $2.3 trillion in 2021—the second largest deficit since 1945.

Source: Congressional Budget Office, as of February 11, 2021.

What if the US debt ceiling is not raised?

Unless a deal is reached to suspend or raise the debt limit, the US will be in danger of defaulting on our national debt. There are some steps the Treasury has already taken to forestall a default, including spending down saved cash and other emergency measures. But those extraordinary measures are expected to be exhausted by sometime in October.

If all of Treasury’s cash balances are drawn and extraordinary measures have been exhausted, the Treasury would be at the limit of the debt ceiling. Such an outcome has not occurred in the modern era, and it remains uncertain as to exactly what developments would transpire next.

However, if Congress still does not raise the debt ceiling, the US government would have to operate on a cash-flow basis, meaning that outflows (including interest payments on existing Treasury debt) would have to be funded by inflows (i.e., tax receipts and fees). Operating in this manner would require prioritization of payments, which could have several negative implications.

Source: Fidelity Investments, July 2021.

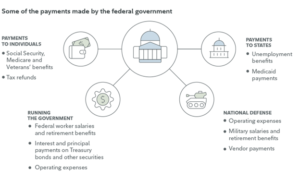

For one, this prioritization would place some counterparties in a subordinate position, which could spook the markets. For instance, during the debt debate in 2013 when the US was only days away from default, prioritization of payments was discussed as a possible option. While principal and interest payments could potentially continue to flow to bondholders, other payments like Social Security benefits could be suspended.

Also, the rating agencies would most likely place the sovereign rating of the United States under review and would potentially lower the rating if a debt-ceiling increase was not enacted. That could significantly increase the cost of borrowing at the national level.

Furthermore, critical functions to operate the government, including spending for military, Social Security, and other programs, would likely be interrupted, pressuring economic activity. Finally, the timing of tax collections is always uncertain, creating the potential for an inadvertent missed interest payment.

Possible implications of a default

An actual default is highly unlikely because of the reverberations that could be expected, including:

Source: Fidelity Investment, July 2021.

Source: https://www.fidelity.com/learning-center/trading-investing/2021-debt-ceiling

Leave a Comment

Posted on December 2, 2021

by C. Todd Fry, CIMA(R), CFS

Raising the National Debt ceiling may seem routine, however, increasing political bias in both parties has made the process anything but simple. Arguments over which party has contributed more to the deficit, through tax cuts or entitlement packages, are passionately articulated, while anxiety grows around the world.

But does raising the debt ceiling really matter? In a word, “yes”. Default would be unthinkable and for that reason history has shown that legislators on both sides of the aisle eventually come together, but not without a fight that can and often does disrupt financial markets. So, should we be concerned? Perhaps, but the question is to what degree. Continue reading for a thoughtful analysis of the impact and implications.

Uncertainty may disrupt financial markets as Congress works toward a deal.

Key takeaways

The suspension of the debt ceiling ended July 31 and Congress has extended the deadline to raise it to December 3, 2021. If the debt ceiling is not raised or suspended again before that time, the Treasury would be unable to issue more Treasury securities and the nation could default on its debt.

History suggests that is unlikely. Congress has always acted to forestall default, though often at the last minute after considerable high-stakes wrangling. That can cause some short-term market volatility.

While that can be upsetting, there are a few things investors can take comfort in:

Says Lars Schuster, institutional portfolio manager in Fidelity’s Strategic Advisers group: “It’s unnerving for investors to see these continual headlines. However, any potential short-term volatility in the markets could be a good buying opportunity.”

Default is unthinkable—so many experts aren’t that worried

The debt ceiling has, in the past, spurred contentious and prolonged debate about fiscal responsibility and the growing national debt.

In 2011, the disagreements went so far that the credit rating agency Standard & Poor’s downgraded the US credit rating to AA+, one step below the best rating of AAA, where it remains today. Standard & Poor’s cited the growing deficit and the prolonged debate as reasons for the downgrade.

This year, as the final deadline looms, the debt-ceiling debate could be a contentious one again. In October, Mitch McConnell, Senate Minority Leader, came under fire from his own party after offering the short-term suspension of the debt ceiling which moved the deadline from October to early December. Without Republican assistance to raise the debt limit or suspend it, Democrats can only use reconciliation to raise the spending limit. That process requires putting a number on the spending limit, making it a politically risky move for Democrats wary of being cast as spendthrifts in upcoming Congressional races.

“It could get really ugly before it gets resolved,” says Andy Vermilye, vice president of government relations at Fidelity.

Historically, raising the debt ceiling has not been a battle legislators want to fight. Administration officials usually work behind the scenes to convince legislators of the importance of raising the limit relatively quickly and without fanfare. This approach helps limit financial market uncertainty, minimizing the potential for government borrowing costs to increase amid a debt-ceiling debate, while reducing investor concerns.

What’s more, many of the same policymakers who negotiated the 2011 debt-ceiling raise will be at the table 10 years later, such as President Biden, Senate Minority Leader McConnell, House Speaker Pelosi, and House Majority Leader Hoyer.

Source: Congressional Research Service, Congressional Budget Office, and the Treasury Department. Data as of 05/01/2021.

Today’s debt

One thing separating today’s debt debate from those of the past is the larger-than-ever national debt. Publicly held US debt topped 100% of GDP in 2020 and is expected to reach 102% by the end of 2021.

And the debt is projected to increase significantly in the future. The Congressional Budget Office (CBO) projects a federal budget deficit of $2.3 trillion in 2021—the second largest deficit since 1945.

Source: Congressional Budget Office, as of February 11, 2021.

What if the US debt ceiling is not raised?

Unless a deal is reached to suspend or raise the debt limit, the US will be in danger of defaulting on our national debt. There are some steps the Treasury has already taken to forestall a default, including spending down saved cash and other emergency measures. But those extraordinary measures are expected to be exhausted by sometime in October.

If all of Treasury’s cash balances are drawn and extraordinary measures have been exhausted, the Treasury would be at the limit of the debt ceiling. Such an outcome has not occurred in the modern era, and it remains uncertain as to exactly what developments would transpire next.

However, if Congress still does not raise the debt ceiling, the US government would have to operate on a cash-flow basis, meaning that outflows (including interest payments on existing Treasury debt) would have to be funded by inflows (i.e., tax receipts and fees). Operating in this manner would require prioritization of payments, which could have several negative implications.

Source: Fidelity Investments, July 2021.

For one, this prioritization would place some counterparties in a subordinate position, which could spook the markets. For instance, during the debt debate in 2013 when the US was only days away from default, prioritization of payments was discussed as a possible option. While principal and interest payments could potentially continue to flow to bondholders, other payments like Social Security benefits could be suspended.

Also, the rating agencies would most likely place the sovereign rating of the United States under review and would potentially lower the rating if a debt-ceiling increase was not enacted. That could significantly increase the cost of borrowing at the national level.

Furthermore, critical functions to operate the government, including spending for military, Social Security, and other programs, would likely be interrupted, pressuring economic activity. Finally, the timing of tax collections is always uncertain, creating the potential for an inadvertent missed interest payment.

Possible implications of a default

An actual default is highly unlikely because of the reverberations that could be expected, including:

Source: Fidelity Investment, July 2021.

Source: https://www.fidelity.com/learning-center/trading-investing/2021-debt-ceiling

Category: Investment Planning, Market Commentary

Recent Posts

Recent Comments

Archives

Categories