Posted on September 19, 2022

See how HSAs can be a tax-efficient part of your retirement planning.

Key takeaways

- HSAs offer a number of benefits beyond spending for the short-term, such as saving for longer-term qualified medical expenses, including those in retirement.

- Because an HSA is one of the most tax-efficient savings options available, consider contributing the maximum and paying for current health care expenses from other sources of personal savings.

- Consider investing a portion of your HSA assets intended for long-term savings in an asset mix that works in conjunction with your other retirement assets.

You may be familiar with health savings accounts (HSAs) as a way to cover healthcare costs with pre-tax dollars. But this tax-efficient savings vehicle can also be used as a powerful tool for retirement savings.

An HSA offers triple tax savings,1 where you can contribute pre-tax dollars, pay no taxes on earnings, and withdraw the money tax-free now or in retirement to pay for qualified medical expenses.

That means if you pay qualified medical costs out of an HSA, the money you take out is tax-free.2 You can even use the money you save for nonmedical expenses after age 65 without any penalties. But note, you are taxed at ordinary income rates on nonqualified withdrawals, just as you would be with a traditional IRA or 401(k). (If you are under age 65, you pay a 20% penalty on nonmedical withdrawals, and you pay the tax in addition to the penalty.)

There are a lot of ways to make HSAs work for you—whether you are still employed, getting ready to retire, or even retired and enrolled in Medicare. To get started, consider these 5 ways that HSAs can help fortify your retirement.

1. Understand the triple tax advantage and how HSAs work

You can save in an HSA if you are enrolled in an HSA-eligible health plan at work or in the private marketplace. Most people think of HSAs as a way to save to cover current medical costs not covered by such plans. But if you can pay for these costs out-of-pocket, the triple tax-free nature of an HSA makes it a powerful vehicle for retirement savings.

Many people contribute to HSAs pre-tax through payroll deductions at work so their contributions also escape FICA taxes. As long as you are enrolled in a health plan that qualifies, you can also open an HSA outside of work and fund it with after-tax dollars, which you then may take as a tax deduction on your personal taxes. These contributions can accumulate tax-free and can be withdrawn tax-free to pay for current and future qualified medical expenses, including those in retirement. If you are no longer covered under a qualifying plan, you can’t continue to make contributions, but you can still hold the account and your previous contributions can continue to grow tax-free.

It gets better: Unlike most flexible spending accounts (FSAs), the money in an HSA can remain in your account from year to year. You can earn interest or earnings with your HSA, and you can even take your HSA with you should you switch employers or retire.

The 2022 IRS contribution limits for health savings accounts (HSAs) are $3,650 for individual coverage and $7,300 for family coverage. For 2023, the IRS contribution limits for HSAs are $3,850 for individual coverage and $7,750 for family coverage.

If you’re 55 or older during the tax year, you may be able to make a catch-up contribution, up to $1,000 per year. Your spouse, if age 55 or older, could also make a catch-up contribution, but will need to open their own HSA.

Because an HSA is one of the most tax-efficient savings options currently available, you may want to consider contributing the maximum allowed and paying for current health care expenses from other sources of personal savings. If you really want the power of HSA compounding to work for you, don’t tap into it, unless necessary. Also consider investing a portion of your HSA in a noncash investment option (see section 3) for long-term growth potential.

2. Earmark savings just for health care

You’ve likely saved for your children’s college expenses in a 529 savings account. It’s a specialized kind of account that lets you save for a specific expense in your future. You may have also earmarked some of your savings for distinct financial goals such as a new car, a special family vacation, or new home. In each case, your investing goal has a different time horizon and should be handled in a different way.

Now think about health care. You’ll likely face a bevy of health care expenses in your future—medical procedures, hospital bills, prescription drugs, maybe even home health care or nursing home expenses. No one knows when these expenses will hit, or how much you may have to pay.

Since you will likely have to pay for large scale health care expenses sometime later in life, building a nest egg specifically designed to help cover future health care costs is a prudent move. But how much should you save?

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2022 may need approximately $315,000 saved (after tax) to cover health care expenses in retirement.

Even if you don’t have an HSA, it may be prudent to set aside certain assets just to pay for health care. “Health care will likely be one of your top 5 expenses in retirement,” says Steven Feinschreiber, Senior Vice President of Financial Solutions at Fidelity. “So consider earmarking a portion of your 401(k)s or IRAs (and their potential future earnings) to help pay for expected health care costs throughout your retirement.”

Tip: Not all health care expenses count as “qualified medical expenses” according to the IRS. Find out which ones you can use your HSA for. Read IRS Publication 502 Medical and Dental ExpensesOpens in a new window to learn more.

3. Consider putting your HSA dollars to work by investing them

Although health care costs continue to rise, there are ways to get ready for any tsunami of medical expenses that might hit in retirement. But you’ve got to save early and put those dollars to work by investing them.

If you think you might need to use some of your HSA for near-term medical expenses, set aside some of your HSA in cash to cover them, and invest the rest for potential tax-free growth and to help fortify your retirement.

“You have several options when thinking about how to put your HSA dollars to work by investing them,” advises Feinschreiber. “Some people choose an investing strategy that is less aggressive than their overall retirement investing strategy,” he adds. Work with your Fidelity advisor to determine an investment strategy that makes sense for you.

Tip: Once you establish a cash cushion within your HSA to pay for short-term unanticipated qualified medical expenses and out-of-pocket maximum deductible limits, you may have a large enough account balance to begin investing. If you’re interested in investing your HSA dollars, Fidelity makes it easy with 2 HSA options—you can choose the self-directed Fidelity HSA® to manage your own investments or the Fidelity Go® HSA to enjoy the benefits of professional money management.

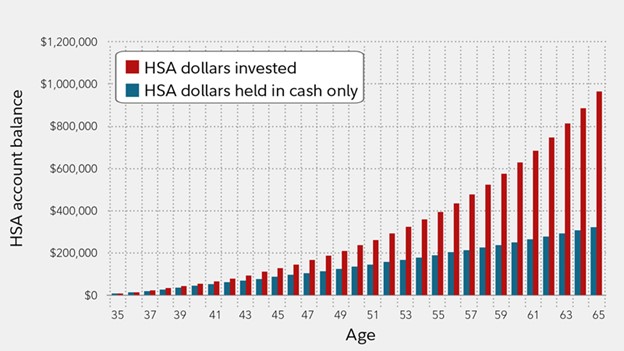

Imagine a family saving and investing their maximum annual HSA contributions over a 30-year period. Not everyone will be able to do this, but the chart below shows a balance of nearly $1 million after 30 years of maxing out HSA savings opportunities and investing at an average hypothetical 7% annual rate of return.4 In fact, if you just left HSA dollars in cash, you’d still have a healthy sum—over $322,000—but you’d be leaving two-thirds of the potential million dollars on the table.

Hypothetical scenario: Invested versus not invested

For illustrative purposes only. Assumptions: 30-year investment time frame; 7% return on investment; 0% return on cash; no withdrawals. The household contributes up to the HSA family limit each year at the beginning of the year. Contributions are indexed to inflation and compounded annually.

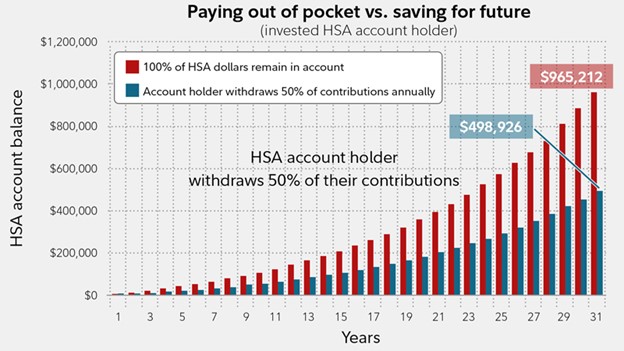

What if you can’t save to the max? Are HSAs still a viable option? Yes. Let’s examine how your HSA can still grow over time—even if you plan to contribute the maximum and then withdraw 50% of the money you put in every year—but remain invested with the rest earning an annual 7% return. In this hypothetical case, we see a family still has access to almost half a million dollars at the end of 30 years (see chart below).

Saving everything versus withdrawing 50% of contributions each year

For illustrative purposes only. This hypothetical example assumes the following: The household contributes up to the HSA family limit each year at the beginning of the year. Contributions are indexed to inflation and compounded annually. The account is invested with a 7% rate of return. The family withdraws 50% of contributions each year.

HSAs vs. other retirement savings options

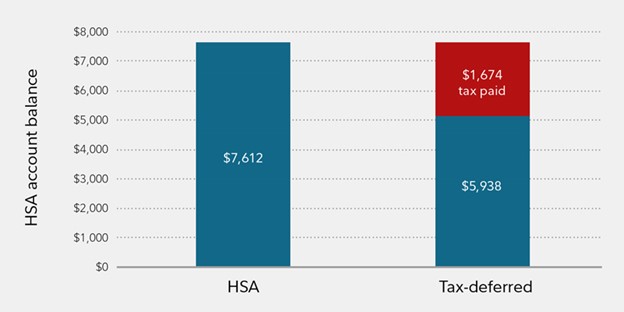

How do HSAs compare to other savings vehicles? The tax treatment of HSAs provides the potential for greater investment growth and greater after-tax balance accumulation versus other retirement or health care savings options. Assuming you use HSA funds to pay for qualified medical expenses, you do not pay any federal taxes. That’s why it’s at the top of the list for tax-efficient investment options for your retirement. In this hypothetical example, a customer invests $1,000 in their HSA.

Over the next 30 years, that single investment of $1,000 grows at 7% a year to $7,612. If that HSA account holder invested the same $1,000 in a tax-deferred account like a traditional IRA, their total investment return would also be $7,612. However, of that amount, only $5,938 remains after paying income taxes at an effective rate of 22% upon distribution.

For illustrative purposes only. This hypothetical example assumes the following: $1000 invested over a 30-year time period. The household files taxes as married filing jointly; has an effective tax rate in retirement of 22%; and their investments generate an annual 7% rate of return.

4. Plan to use your HSA in retirement

You can always use your HSA to pay for qualified medical expenses like vision and dental care, hearing aids, and nursing services at any time. Once you retire, there are additional ways you can use the money:5

1. Help bridge to Medicare

If you retired prior to age 65, you may still need health care coverage to help you bridge the gap to Medicare eligibility at 65. Generally, HSAs cannot be used to pay private health insurance premiums, but there are 2 exceptions: paying for health care coverage purchased through an employer-sponsored plan under COBRA, and paying premiums while receiving unemployment compensation. This is true at any age, but may be helpful if you lose your job or decide to stop working before turning 65.

2. Cover Medicare premiums

You can use your HSA to pay certain Medicare expenses, including premiums for Part B and Part D prescription-drug coverage, but not supplemental (Medigap) policy premiums. For retirees over age 65 who have employer-sponsored health coverage, an HSA can be used to pay your share of those costs as well.

3. Long-term care expenses

Your HSA can be used to cover part of the cost for a “tax-qualified” long-term care insurance policy. You can do this at any age, but the amount you can use increases as you get older.

4. Pay for other expenses

Once you hit 65, you can use your HSA to pay for any nonqualified medical expenses (including buying a boat, for example), but you don’t get to take full advantage of the tax savings as you will be required to pay state and federal taxes on those distributions.

5. Let HSAs play a role in your estate plan

In the event that your medical expenses are much lower than average (or you don’t live that long), you may have money in your HSA that you can pass along to your heirs. The rules are complicated so it’s best to consult your estate planning attorney. There are generally 3 categories to consider when determining how HSA assets are treated upon your death:

1. Spouse is the designated beneficiary

If your spouse is the designated beneficiary of your HSA, it will be treated as your spouse’s HSA after your death with the same triple-tax-free treatment.

2. Spouse is not the designated beneficiary

If your spouse isn’t the designated beneficiary of your HSA, the account stops being an HSA, and the fair market value of the HSA becomes taxable to the beneficiary in the year in which you die.

3. Your estate is the beneficiary

The fair market value of the HSA is included on your final income tax return.

Of the 3 options listed, many people would prefer to name the surviving spouse as the designated beneficiary. However, if you don’t have a surviving spouse, a planning consideration could be tax-efficiency. In that case, consider naming as beneficiary (either your estate or beneficiary), whichever party is in the lowest tax bracket. Work with your tax and estate planning professionals to determine which option is right for you.

Tip: One caveat: If you name your estate as the beneficiary of your HSA, it will likely become a probate asset and it still needs to fit in with your overall estate plan.

Plan ahead

Typically, once you turn 72, you will need to take required minimum distributions from traditional IRAs and 401(k)s, and you would have to pay taxes on those distributions. For HSAs, there is no required minimum distribution.

Since an HSA offers a triple-tax advantage, it’s an option you should consider prioritizing to fortify your retirement now and for years to come.

1. With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation. Please consult with your tax advisor regarding your specific situation.

2. With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation. Please consult with your tax advisor regarding your specific situation.

3. A distribution from a Roth IRA is tax free and penalty free, provided the five-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, qualified first-time home purchase, or death.

4. All estimated dollar amounts for assets needed to pay for future medical costs assume an investment portfolio of 30% equity, 50% bonds, and 20% short-term investments.

5. IRS Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans

* Estimate based on a hypothetical opposite-sex couple retiring in 2022, 65-years-old, with life expectancies that align with Society of Actuaries’ RP-2014 Healthy Annuitant rates projected with Mortality Improvements Scale MP-2020 as of 2022. Actual assets needed may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Cost Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, Original Medicare. The calculation takes into account cost-sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by Original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Investing involves risk, including risk of loss.

The direct purchase of precious metals and other collectibles in an IRA or other retirement plan account can result in a taxable distribution from that account (except as specifically provided under IRS rules). If precious metals or other collectibles are held in an ETF or other underlying investment vehicle, you should first confirm that such an investment is appropriate for a retirement account by reviewing the ETF prospectus or other issuing documentation and/or checking with your tax advisor. Some ETF sponsors include a statement in the prospectus that an IRS ruling was obtained providing that the purchase of the ETF in an IRA or retirement plan account will not constitute the acquisition of a collectible and as a result will not be treated as a taxable distribution.

The information provided herein is general in nature. It is not intended, nor should it be construed, as legal or tax advice. Because the administration of an HSA is a taxpayer responsibility, you are strongly encouraged to consult your tax advisor before opening an HSA. You are also encouraged to review information available from the Internal Revenue Service (IRS) for taxpayers, which can be found on the IRS website at IRS.gov. You can find IRS Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans, and IRS Publication 502, Medical and Dental Expenses, online, or you can call the IRS to request a copy of each at 800-829-3676.

A qualified distribution from a Roth IRA is tax-free and penalty-free. To be considered a qualified distribution, the 5-year aging requirement has to be satisfied and you must be age 59½ or older or meet one of several exemptions (disability, qualified first-time home purchase, or death among them).

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

857517.6.2

Source: https://www.fidelity.com/viewpoints/wealth-management/hsas-and-your-retirement#:~:text=Once%20you%20hit%2065%2C%20you,federal%20taxes%20on%20those%20distributions

FIDELITY WEALTH MANAGEMENT

08/22/2022

Recent Comments