Posted on November 17, 2022

10 Tax Planning Tips for the End of the Year

Tax planning between now and the end of the year can have a significant impact on how much tax you have to pay next April.

Financial decisions you make between now and the end of the year can have a significant effect on how much tax you have to pay next April. This is particularly true if you’re saving for retirement, itemize deductions, or hold investments outside a retirement account.

But time is running short. It will be too late to cut your tax bill using most of the tips we’ve assembled below after we ring in the new year. So check out our list right away and get cracking

Posted on November 17, 2022

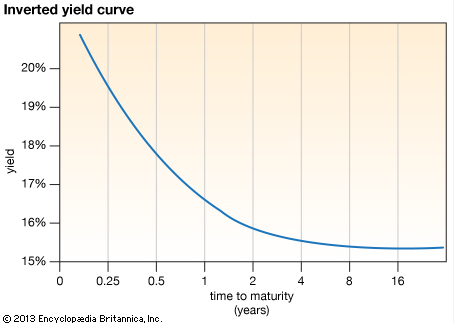

The Fleeting Free Lunch of an Inverted Yield Curve

Fixed Income is once again an attractive investment thanks to steep increases in the Federal Funds rates this year. Short term yields, however, have outpaced their longer-term counterparts, leading to what is know as an inverted yield curve. Many investors are eager to secure the higher yielding, short-term issues. Are they being short-sighted?

The Fleeting Free Lunch of an Inverted Yield Curve

Posted on October 18, 2022

What Property to Put in a Living Trust

For the greatest benefit, hold your most valuable property items in your living trust.

Posted on October 18, 2022

When will the Bear Market End?

As stocks and bonds continue to tumble a week after the Federal Reserve’s latest rate hike, investors are understandably asking how long this painful bear market will persist.

Posted on September 19, 2022

Can Midterm Elections Move Markets? 5 Charts to Watch

In a year when soaring inflation, the war in Ukraine and a bear market have commanded headlines, the U.S. midterm elections risked becoming an afterthought. But now the election is coming back into focus. And with good reason. Capital Group political economist Matt Miller believes 2022 could be one of the more consequential midterm elections in U.S. history.

“Make no mistake, every move in Washington this year has been carefully calculated with the midterms in mind,” Miller says.

But while control of Congress may be at stake, do midterm elections have any effect on equity markets?

Posted on September 19, 2022

5 Ways HSAs Can Help With Your Retirement

See how HSAs can be a tax-efficient part of your retirement planning.

Key takeaways

- HSAs offer a number of benefits beyond spending for the short-term, such as saving for longer-term qualified medical expenses, including those in retirement.

- Because an HSA is one of the most tax-efficient savings options available, consider contributing the maximum and paying for current health care expenses from other sources of personal savings.

- Consider investing a portion of your HSA assets intended for long-term savings in an asset mix that works in conjunction with your other retirement assets.

You may be familiar with health savings accounts (HSAs) as a way to cover healthcare costs with pre-tax dollars. But this tax-efficient savings vehicle can also be used as a powerful tool for retirement savings.

Posted on September 19, 2022

Fed Chair Powell’s 1970s Lesson Casts Doubt on Quick Pivot

Federal Reserve chief Jerome Powell, in his much-anticipated Jackson Hole, Wyo., speech, said Friday that policymakers can’t let their guard down too early, or they’ll risk letting high inflation become entrenched. After release of the transcript, the S&P 500 turned sharply lower.

Posted on August 5, 2022

How a Financial Plan Helps You Endure Market Volatility

Although most investors remain constructive on markets over the long-term, periods of volatility–often the result of significant economic stress–are common. The best way to maintain perspective is to have a plan. Through planning, we can assess the effects of periodic down markets on your ability to realize your objectives. If your plan can not weather the down turns, it does not represent a viable financial strategy.

How a Financial Plan Helps You Endure Market Volatility (for future Insights, etc.)

Posted on August 5, 2022

Seller Beware

Seller Beware: US Homebuyers are backing out of deals at the highest rate since the start of the pandemic – here’s what that means for real estate.

Leave a Comment

Posted on October 18, 2022

Student of the Market

by C. Todd Fry, CIMA(R), CFS

Student of the Market (October 2022)